| The Courier - N°158 - July - August 1996 Dossier Communication and the media - Country report Cape Verde source ref: ec158e.htm |

| ACP |

The economy of Cameroon: Better prospects but still a long way to go

It is an astonishing sight to behold during the rainy season. As you drive along the road from Yaoundé to Bamenda, you come to a point where human habitation starts - and it then continues unbroken for more than 100 kiLométres. Just before Bafoussam, and as far as the eye can see, every patch of land is cultivated. Bananas, oranges, mangoes, sugarcane, cassava, palm trees, groundnuts and maize grow luxuriantly in open fields and in the front and back gardens of many houses. This route, of course, takes you mainly through the western part of Cameroon, home to the Bamilelrés, recognised as one of the country's most enterprising and industrious ethnic groups. The population density here is 200 per km2 as opposed to 1 per km2 in the East.

The impact of this widespread farming, carried out by a large number of smallholders, is visible in the local markets, whether in Bafoussam, Mbouda or Bamenda. There, the stalls overflow with fruits and vegetables and prices are very low - a virtual paradise for the middlemen whose unmistakable presence is signalled by the significant number of trucks loading the produce for distribution throughout the country.

These scenes come as no surprise to the long-time observer of Cameroon's economy. The country achieved virtual self-sufficiency in food over 15 years ago. It is one of the few African countries to have been able to do this, thanks both to its physical endowments and an early recognition of its agricultural vocation.

Cameroon is often described as a microcosm of Africa, not just in terms of its make-up of English- and French speaking communities, but because it enjoys almost all the continent's climatic conditions. The south is equatorial, with two rainy seasons and two dry seasons of equal duration, the centre is Savannah country with one rainy season and one dry season, while the extreme north (part of the Sahel) is hot and dry. The country has a very good supply of rainfall - from 5000 mm annually in the southwest to around 600 mm near Lake Chad.

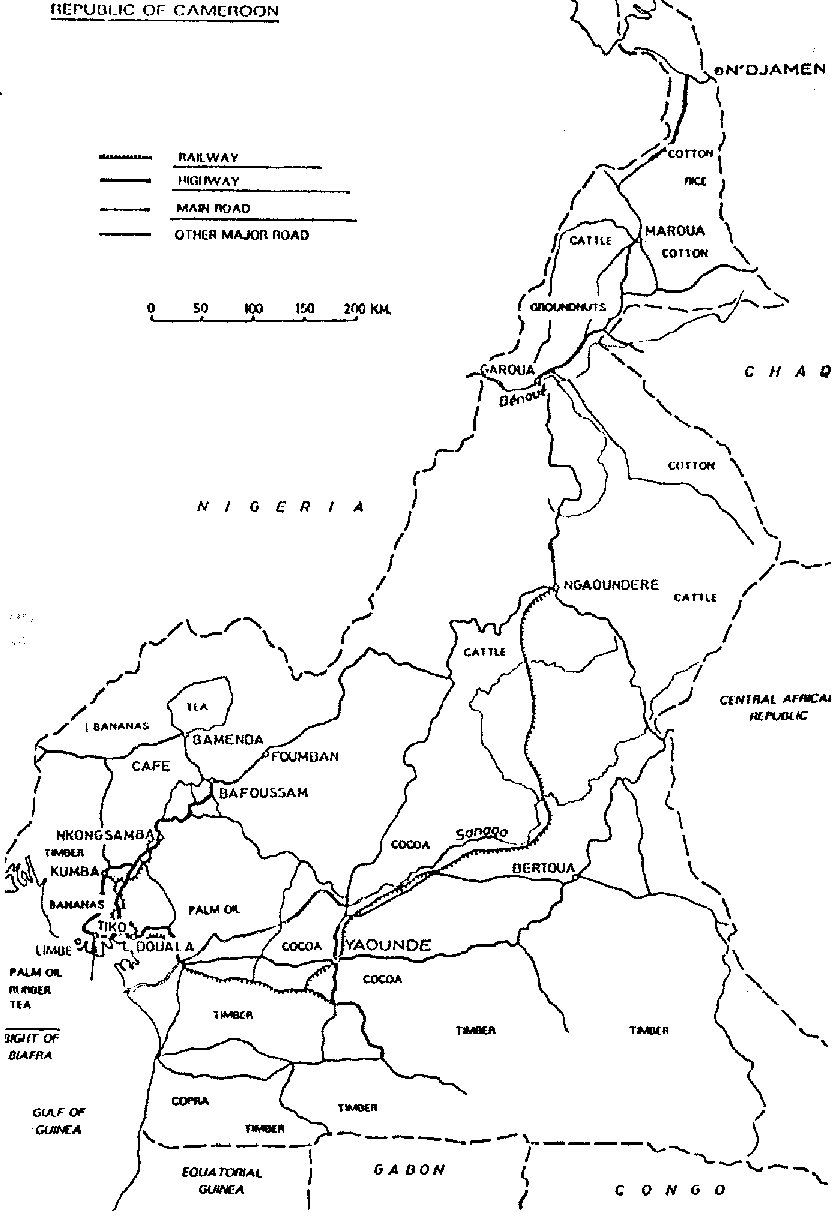

Such varied climates favour the cultivation of a variety of crops. Timber is produced mainly in the southern provinces while palm oil, tea, cocoa, coffee, rubber, timber and foodcrops are produced in the southwestern and western areas. The central and north provinces specialise in cattle and cotton production.

Concentration on agriculture

Cameroon has, not surprisingly, concentrated on agriculture. Indeed the government has given top priority to the sector in all its development plans since independence in 1960. It has been involved in the marketing of the main export crops and has provided subsidies to farmers in the form of low-priced fertilisers and pesticides for their cocoa, coffee, rubber, palm oil, etc. Almost three-quarters of the working population (the majority of whom are smallholders) are engaged in farming. And despite a low level of mechanisation, they are very efficient. The rate of growth in food outstrips the rate of population growth. Only a few largescale farmers or firms are involved in the production of cash crops.

Until the early 1980s, when oil came into the picture, these large scalefarmers and firms amounted for more than 70% of export earnings, 40% of state revenue and 32% of the Gross Domestic Product. The plan initially was to use oil revenues to further boost and transform agriculture. However, the dramatic increase in the country's oil production, combined with much higher world petroleum prices during the first half of the 1980s, made the sector not only Cameroon's biggest export earner, but also, in a certain sense, a 'spoiler' for agriculture. Increased revenues enabled the government to maintain the level of prices paid to farmers, even though world prices had slumped to disastrous levels. This created distortions in the market. (Later, when the oil price slumped, and revenues dropped sharply, producer prices were also reduced, bringing them closer into line with international prices.)

Agriculture's contribution to GDP declined steadily to around 21 % in 1985, rose to 27% in 1989 and has hovered around 30% ever since. The sector's share of export earnings has also fallen to about 40% of total exports by value.

Despite this, Cameroon's agriculture remains, comparatively, in a much better shape than that of most African countries. Indeed, it contributed in large measure to the country's reputation as one of Africa's economic successes in the 1980s. During that decade, growth averaged 8% per annum. However, the period was also marked by dramatic increases in oil revenues which induced significant policy changes as well as leading to maladministration. The government paid less attention to taxation and customs duties as sources of income and turned a virtual blind eye to smuggling which harmed the manufacturing sector. The civil service, on the other hand, expanded beyond reason, a phenomenon that some have attributed to patronage by the ruling single party.

Boom in public expenditure

Protected somewhat against fluctuations in earnings from export crops, by a strong but overvalued CFA franc, the government embarked on a wide range of capital expenditure and imports. Then, in 1987, international oil prices fell as dramatically as they had risen earlier in the decade. At the time, public spending was running at CFAF 8 billion - well above the CFAF 5.6bn the country actually earned. Revenues from oil continued their downward slide to CFAF4.5 bn in 1988, CFAF 2.8 bn in 1991 and CFAF 2.5 bn in 1994. 1995 saw a modest rise to CFAF 3 bn.

1987 thus marked the beginning of a rapid deterioration in Cameroon's financial situation. In the period which followed, civil servants' salaries were unpaid for months, several of the country's foreign missions were left without resources and both domestic and foreign debts worsened. In 1993, the government owed commercial banks around CFAF 3.3bn. Its external debt stood at around $7.5bn with a service ratio of more than 25% of foreign exchange earnings. The devaluation of the CFA franc in January 1994 improved the internal debt situation significantly. In February, the government signed a letter of intent with the IMF after agreeing to a series of reforms which included, among other things, rationalising the banking and insurance sectors, raising revenue from non-oil sources, bringing inflation down and reducing the budget deficit. In return the IMF provided a stand-by loan equivalent to CFAF 1.4bn. However, the agreement was suspended just a few months later when the Fund reached the conclusion that the government lacked the will to carry the reforms through. The 1994/95 budget foresaw a deficit of 4.5% of GDP - well above the IMF's guideline of 1.5%.

Meanwhile the country's financial situation had become so critical that it could no longer service its debts, most notably, those it owed to the World Bank. France, which had traditionally been ready to come to the rescue, refused to bail Cameroon out and it finally dawned on the authorities that structural adjustment was unavoidable. When, in September 1995, talks resumed with the IMF, the commitment to adjustment was no longer in doubt. The government agreed, in addition to fiscal reforms, to liberalise trade in cocoa, coffee and timber, to prune the civil service and to privatise state enterprises which dominate the industrial sector.

Commitment to reforms

Since then the reform process has been in full swing. The first and most important task has been to improve the government's financial position. The civil service, which employs more than 175000 people, is gradually being reduced and salaries have been cut. Trade is also being liberalised and subsidies are being removed. The 1995/96 budget, unveiled in June last year, was welcomed by the IMF. It included, for the first time in a long while, increases in income tax and a widening of tax bands. A series of measures have also been introduced to combat tax evasion and fraud. External signs of wealth, water and electricity consumption, and telephone bills are now being used as means of assessing income tax.

Responsibility for the collection of customs duties has been removed from the Customs Department which was often accused in the past of corruption and inefficiency. The task has been given instead to a Swiss-based preshipment inspection company.

The donor community has responded positively. With French assistance, the government has been able to clear its outstanding debt to the World Bank. The IMF has provided a stand-by credit facility of $101 million in support of the adjustment programme for 1995/ 96 and debts to the Paris Club covering the same period have been rescheduled. In addition, now that Cameroon has been reclassified as a poor country, it is entitled to benefit from the terms of the Naples Agreement, which allow for up to 67% of debts to western govemments to be written off. A number of creditor nations have either forgiven the country its debts or have reduced them substantially. More loans have come from France and a number of other donors, including the World Bank and the European Community.

The EC is financing a series of projects within the framework of the adjustment programme, including the restructuring of the civil service and preparation of the ground for privatisation.

Lately though, the donor community has been showing signs of disenchantment, following allegations of misuse of funds and perhaps even outright embezzlement. Last March, an IMF mission to Yaoundé failed to obtain an adequate explanation concerning the allocation of certain sums. The result, at the time The Courier went to press, was that an IMF loan for settlement of Cameroon's debt to the African Development Bank was being held up.

Dealing with the negative social impact

Figure

The sudden devaluation of the CFA franc in January 1994 halved Cameroon's purchasing power overnight. The government has since cut wages twice. The average salary of a top civil servant, which stood at around CFAF 300 000 before devaluation, is now less than CFAF 180 000 while the lowest paid government employees receive just CFAF 30 000. At the same time, prices, particularly of imported manufactured goods and inputs, have risen sharply. Increases of up to 150% have been recorded. By way of example, the price of a baguette (french bread), which was only CFAF 80 in January 1994 had risen to CFAF 130 by March 1996.

Although there is considerable hardship, Cameroonians are a great deal more fortunate than fellow Africans in many other countries undergoing a similar adjustment process. Staple food remains cheap and affordable to the vast majority, thanks to the continuing strength of agriculture. As a result, there are few, if any, cases of malnutrition.

A number of donors, including China, Belgium and the EC, are concentrating on health and education with the specific aim of reducing the negative social impact of adjustment. The EC, for example, has a project designed to strengthen health provision at the grassroots. This entails rehabilitating infrastructures (health centres and district hospitals in particular) and establishing medical supply centres in areas that are not covered by other donors. The project is governed by the principle of cost-recovery to ensure viability and sustainability. But one area where the donors cannot do much is in the field of job creation. There is growing unemployment and job prospects in the formal sector, at least in the short term, are not good.

In macro-economic terms, things are locking up slightly for Cameroon. After recording economic growth of 3% in 1994/95, the hope is for a 5% increase in 1995/96. However, Cameroon's main economic operators, grouped under the umbrella of GICAM (Groupement inter-patronal du Cameroun), expressed fears late last year that the country would not achieve this level of growth.

Cameroon exports a variety of primary commodities, most of whose prices have recovered in recent years, and devaluation has had a positive impact on the country's balance of trade. Specifically, it has helped make exports more competitive and in 1994/ 95 the trade surplus was a healthy CFAF 349bn, almost double the CFAF 128bn recorded in the previous year. There was a noticeable slowdown in the export of timber in the latter half of last year and the qualities of coffee and cocoa being sold were not up to the usual standard, a situation that led to both crops being shunned in the world market. Bananas exported to France were also meeting stiffer competition from French Caribbean bananas. However, the fact that rubber production has risen by more than 10%, while aluminium output and sales have increased, should help Cameroon to record another positive trade balance when the figures are next published.

The forestry sector, which has huge foreign-exchange earning and employment potential, is being rationalised as part of the current structural adjustment programme. The Canadian Agency for International Development

(CAID) has a five-year project to conserve and regenerate some 30 000 hectares. In fact, half of Cameroon is covered by forest and less than 500 000 ha is currently being exploited. The objective is to ensure that forest resources are exploited in the future at a sustainable level.

The private sector

Industry, which is still in its infancy, has been developed by the government since independence largely with a view to import-substitution, although with some gearing towards the regional market. It accounts for about 14% of GDP and is currently dominated by aluminium smelting. Although devaluation has lately improved the competitiveness of those enterprises that add value to locally available raw materials, the manufacturing sector as a whole faces two major challenges now that the government has accepted the idea that the economy is best driven by the private sector.

The first relates to private investments, which have been sluggish over the past ten years; a clear illustration of a lack of confidence in the economy. This was amply demonstrated when Cameroonians with funds abroad failed to repatriate them to take advantage of the CFAF devaluation as was widely expected. This phenomenon puts the whole privatisation exercise in jeopardy as it means that the government is more likely to have to rely on foreign entrepreneurs. The best the authorities can therefore expect in the short term, some observers say, is to convert those state enterprises that are not already joint-ventures into ones where private investors become the majority shareholders. Complete divestment will then take place gradually over a longer timescale. Overall, 150 state enterprises have been earmarked for sale.

According to André Siaka, director of Cameroon's Brewery, who is also Chairman of GICAM, another reason for the lack of investment was high interest rates. These hovered around 20% for many years. Even now, after the reform of the banking sector, interest rates remain very high and there are no borrowers, he told The Courier.

Donors again have been conscious of this and some of their interventions have reflected this concern. For example, Canada is providing funds for the establishment in Douala (the commercial capital) of a centre for the development of private enterprises. Meanwhile, the Chinese have promised to provide CFAF 7bn to enable a line of credit to be opened for small and medium sized enterprises.

The government itself is puting in place a number of incentives, according to Minister of Trade and Industry Eloundou Mani Pierre. The liberalisation of the economy and the reform of the customs regime in collaboration with UDEAC, to which Cameroon belongs, are part of these. Mr Mani told The Courier that with a population of under 12 million, Cameroun's most important market was Central Africa. He also, perhaps surprisingly, has high hopes for the new World Trade Aareement.

Cameroon meanwhile is reviewing its plan for the establishment of export processing zones with the help of its main donors.

It is also looking at other ways of attracting foreign investment, particularly in 'value-added' enterprises involved in the processing of locally available raw materials such as cotton, cocoa, coffee and timber.

Social and political peace

The second, and by far the more serious challenge facing manufacturing, is the problem of large-scale smuggling by petty traders.

Evidence of this abounds in the booming central market of Douala, where goods of all kinds can be found at very reasonable prices. Ironically the measures which were being taken and judged to be relatively effective against smuggling in recent years have had to be abandoned under structural adjustment rules imposed on the government.

As Mr Siaka pointed out, petty traders dealing in smuggled goods put pressure on enterprises, 'because they do not pay tax', and threaten to render domestic manufacturing uncompetitive. It is also widely acknowledged, however, that the small-scale traders, who dominate the informal sector, provide job opportunities to Cameroonians, which is important at a time of economic austerity. Indeed petty trading has arguably been the safety-valve, helping to ease the social pressures brought about by structural adjustment, and thus preventing civil unrest.

But the extent to which that safety-valve can withstand the emerging political pressures is a different matter. Democratisation, understandably, was one of the conditions imposed by donors for assistance to Cameroon. After a series of elections - presidential, legislative and municipal - which were marred by violence and deaths, there are still doubts about the health of democracy in the country. Indeed, there are signs that tension is mounting. And few would dispute that if Cameroon is to succeed economically, it needs both social peace and political stability.

Augustin Oyowe